In a significant move towards sustainability, Microsoft has partnered with Brazilian company...

Shell and Microsoft: Pioneering Carbon Credit Strategies in 2024

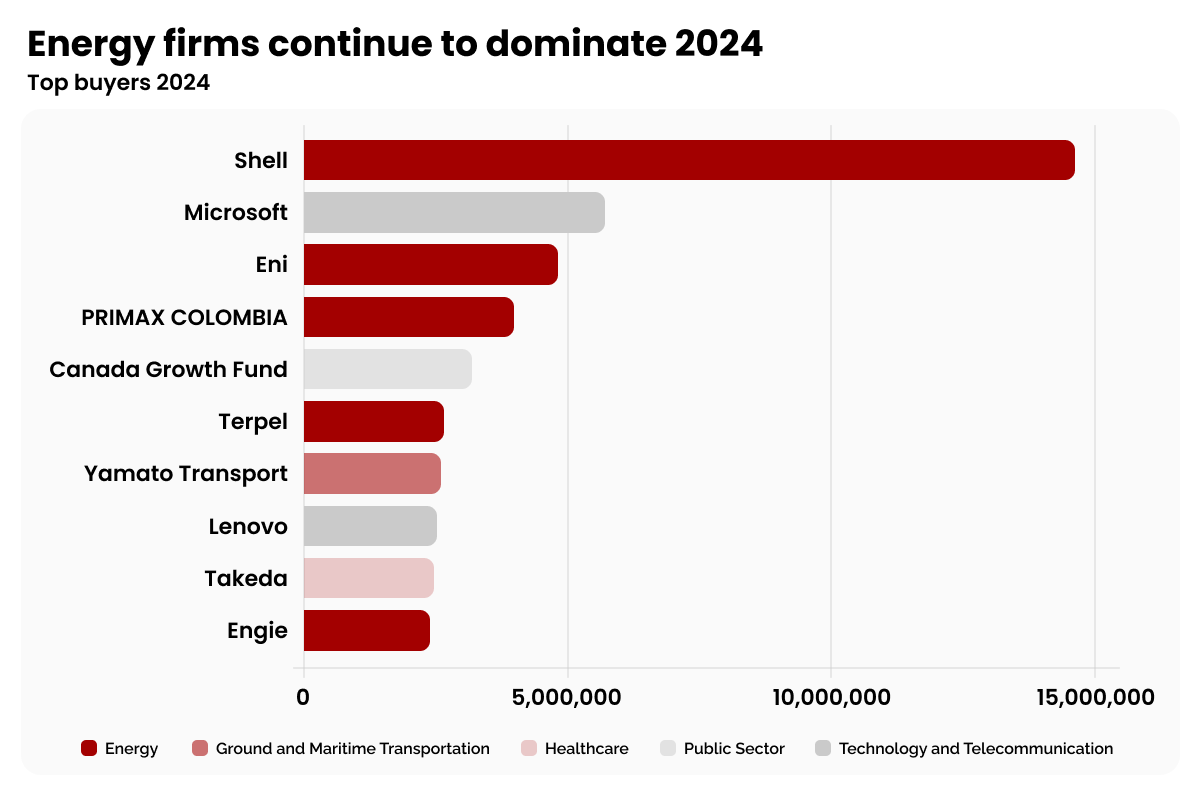

Shell and Microsoft have established themselves as the top buyers in the voluntary carbon market (VCM) in 2024, as reported by Allied Offsets. While both companies share the objective of reducing emissions, their strategies reveal significant differences, reflecting evolving trends within the carbon market.

View from below of two tall green trees with lush, leafy tops. AI generated picture.

View from below of two tall green trees with lush, leafy tops. AI generated picture.

Shell: Scaling Emission Avoidance Projects

For the second consecutive year, Shell retained its position as the largest buyer in the VCM, retiring 14.5 million carbon credits. Of these, 9.4 million supported forestry and land-use initiatives focused on preventing emissions by protecting existing carbon stores. While these cost-effective projects are pivotal to Shell’s strategy, they have faced scrutiny over their environmental impact.

Additionally, Shell retired 2.4 million renewable energy credits, emphasising affordability and large-scale impact. With credits averaging $4.15 each, Shell’s approach prioritises cost efficiency while aligning with its broader sustainability targets. Notably, the company has announced plans to reduce its involvement in nature-based solutions, signalling a shift in its portfolio.

Shell is committed to achieving net-zero emissions by 2050, with interim goals to reduce operational emissions by 50% by 2030, using 2016 as a baseline year.

A chart illustrating energy firms' dominance in 2024 on the carbon credit market.

A chart illustrating energy firms' dominance in 2024 on the carbon credit market.

Microsoft: Advancing Carbon Removal Technology

In contrast, Microsoft retired 5.5 million credits, focusing on cutting-edge carbon removal solutions. Nearly 80% of its credits were linked to bioenergy with carbon capture and storage (BECCS) projects, including a significant partnership with Stockholm Exergi in Sweden. This emerging technology captures and stores carbon released during biomass combustion, delivering carbon-negative results critical to net-zero goals.

Microsoft’s commitment comes with a higher price tag, with average credit costs of $189 in 2024. Despite the financial challenge, Microsoft remains focused on its goal to become carbon-negative by 2030, showcasing its leadership in sustainable innovation.

Trends and Challenges in the Carbon Market

The VCM in 2024 witnessed increasing demand for carbon removal projects, even as overall credit retirements remained flat for the third consecutive year. While renewable energy and forestry projects remain dominant, their share has dropped from 80% in 2020 to 70% in 2024, signalling a shift toward innovative solutions like BECCS and direct air capture.

Challenges such as oversupply persist, particularly with older Clean Development Mechanism (CDM) credits, which have been criticised for limited additionality. However, the number of buyers grew slightly in 2024, with over 6,500 companies—primarily from the energy and financial sectors—participating.

Key Takeaways

Shell’s emphasis on affordability and large-scale impact contrasts with Microsoft’s focus on high-tech carbon removal solutions. As both companies lead the VCM, their differing strategies offer a roadmap for other organisations exploring carbon credits as a pathway to sustainability.